Table of Contents:

As a business owner, it’s important to be aware of all the tax forms required to keep your company in the IRS’ good graces. At Innovation Refunds, we work with a team of independent tax professionals to help business owners like you make the best decisions for their companies, which starts with following IRS guidelines and reporting requirements.

Our team of independent tax professionals aim is to provide clarity and guidance, so you gain a comprehensive understanding of these forms and their implications on your tax filing process. Let’s reduce the complexities and equip you with the knowledge needed to confidently tackle these crucial tax forms.

What’s the difference between Form 941 and Form 944?

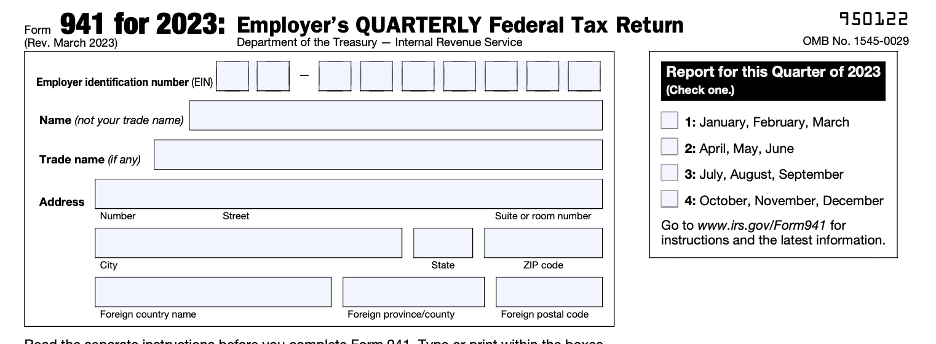

Form 941, the Employer's Quarterly Federal Tax Return, is a tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employees' wages. Additionally, it allows employers to pay their share of Social Security and Medicare taxes. This form is a quarterly obligation, meaning it’s due four times a year.

On the other hand, Form 944, the Employer's Annual Federal Tax Return, is an alternative to Form 941. It’s aimed at small businesses with an annual tax liability of $1,000 or less for Social Security, Medicare, and withheld federal income taxes. For those eligible, this form simplifies the tax filing process by reducing the frequency of filings to once a year.

The Internal Revenue Service (IRS) provides all the information you need about these forms on its website. Let’s dive deeper into each form so you have answers to any questions that may have come up.

What is Form 941?

Form 941 is mandatory for most employers, especially those who withhold taxes from their employees' wages. This form provides crucial information to the IRS and allows employers to reconcile the taxes they withhold from employees' paychecks. Essentially, filing Form 941 ensures that employees will receive important benefits like Social Security and Medicare.

Employers need to file Form 941 by the last day of the month following the quarter's end. The due dates are typically April 30, July 31, October 31, and January 31.

Pro tip: Make sure you file this form on time to avoid penalties and interest charges.

What is Form 944?

Form 944 is an annual filing option available to eligible small businesses. If you're a small business owner who has received written notice from the IRS, you can choose to file Form 944 instead of Form 941. This is a beneficial option that reduces the quarterly filing burden for employers while simplifying the tax reporting process.

The eligibility criterion for Form 944 is having an annual liability of $1,000 or less for Social Security, Medicare, and withheld federal income taxes. If you're unsure about your eligibility, you can review the guidelines provided by the IRS or contact them directly for clarification.

Pro tip: If you’re a church or non-profit organization, you are generally not eligible for Form 944 and should file Form 941, regardless of your annual tax liability.

How should I file Form 941?

Step 1

The first step to filing Form 941 is to gather all the necessary information, including:

1. Your Employer Identification Number (EIN)

2. Details of wages paid to employees

3. Federal income tax withheld

4. Both the employer and employee portions of Social Security and Medicare taxes

You can determine the appropriate filing period based on the calendar quarter, which includes Q1, Q2, Q3, or Q4.

Step 2

Next, obtain the latest version of Form 941 from the official IRS website or request a paper copy. Fill out the form completely, ensuring that all sections are accurately completed, including employer information, wage and tax details, adjustments, and the total tax liability. Review the form for any errors or inconsistencies before submitting it.

Step 3

Once you have completed Form 941, you can choose to either mail the form to the designated IRS address based on your location or file electronically using the IRS e-file system or an authorized e-file provider.

If you have a tax liability, make the necessary payment along with your filing using the available payment options provided by the IRS. It is essential to retain a copy of the filed Form 941 and all supporting documents for your records in case of any future inquiries.

Pro tip: Remember to meet the filing deadlines, which require submitting Form 941 by the last day of the month following the end of the quarter.

By following these steps and staying compliant with the IRS guidelines, you can successfully file Form 941 and fulfill your business’ payroll tax obligations.

How should I file Form 944?

The IRS encourages electronic filing to simplify the process and ensure accuracy. You can easily file Form 944 through the IRS e-file system, which provides a convenient and efficient way of submitting your form. The benefits of e-filing include reduced chances of making errors and a potentially faster response from the IRS.

To access the e-file system, visit the IRS website and search for "e-file for business." Follow the instructions provided to complete and file Form 944 electronically.

If you prefer, you can also file by mail. Simply download the form, fill it out manually, and send it to the IRS address provided on the form.

Choosing the Right Form: Form 941 or Form 944?

The IRS offers a "Should you file Form 944 or 941?" resource on their website to help employers understand their obligations and select the appropriate form based on their eligibility.

Before reporting, get familiarized with IRS guidelines and deadlines so everything goes smoothly from start to finish.

Form 941 and Form 944 are significant tools for employers to report their tax liabilities and comply with federal regulations. By understanding the differences and specific requirements of each form, employers can navigate the tax filing process more efficiently.

At Innovation Refunds, we’re here to help employers navigate payroll tax filing. Our team of independent tax attorneys can provide you with guidance on how to best use IRS forms 941 and 944 for your business’ needs, as well as determine your eligibility for the Employee Retention Credit.

Check my eligibility for the ERC

*Innovation Refunds works with a team of independent tax professionals. We will share your information with these professionals to evaluate and process your claims. Innovation Refunds does not provide tax or legal advice. Terms & conditions apply.